Proposed Rules May Strengthen China’s ESG Disclosure

Mandatory environmental information disclosure requirements for companies proposed by the Ministry of Ecology and Environment (MEE) could improve investor access to data and risk assessment around environmental, social and governance (ESG) factors in China, says Fitch Ratings.

The impact of the rules would be limited initially due to weak penalties for breaches, but we anticipate a gradual strengthening in disclosure standards as other regulators impose further requirements.

The MEE’s month-long consultation around the new requirements closed on 24 October 2021:

“The measures proposed would require relevant companies to disclose a variety of environment-related information. This would help investors to make better informed judgements on the impact of firms’ financing activities on environmental issues, such as climate change.”

The information disclosures would be included within the national enterprise credit information publicity system, a publicly accessible database on Chinese corporates.

The low penalties proposed for companies that do not disclose the environmental information as mandated, with fines that are only up to CNY100,000 (USD15,536), would limit the initial impact, in our view. Nonetheless, the introduction of the proposed regulation would be significant as it would mark China’s first mandatory ESG information reporting scheme.

The changes would be aligned with the government’s goal of establishing a nationwide mandatory environmental disclosure system by 2025, as part of efforts to support more sustainable growth and achieve carbon emission targets. However, there remains a risk that the authorities may inhibit the disclosure of certain environmental information by companies if they consider it against national or local government interests.

The regulations are likely to serve eventually as the basis of a more comprehensive ESG reporting structure, involving China’s other market regulators, in our view. We expect the number of firms covered to be gradually expanded over time to include most major companies, with the range of ESG disclosures also likely to increase. Some regulators have previously made efforts to promote ESG disclosures, usually under voluntary initiatives, but the MEE proposals go significantly beyond these.

Fitch believes that leading Chinese corporate issuers are better placed to respond to the increased regulatory focus on environmental factors. Decarbonisation and other green projects may lead to a temporary increase in investment and costs, but we expect stronger issuers to benefit in the long term from improvements in operational efficiency, mitigation of regulatory risk, and lower capital costs. The credit profiles of smaller companies that perform poorly on the environmental front may deteriorate due to potential regulatory intervention and higher operational and financing costs.

“The new MEE rules, as put forward, could help close the reporting gap between China and international practice as most major markets require a degree of mandatory reporting on ESG factors. Nonetheless, the extent to which the scheme would be aligned with international reporting standards remains unclear.”

Improved disclosure and standardisation of ESG metrics in China would allow better comparison of Chinese corporates against local and international peers, benefiting the rising number of local and international investors with ESG mandates. Still, we think the level and quality of the disclosure in China will continue to fall short of that in the US or EU over the next few years.

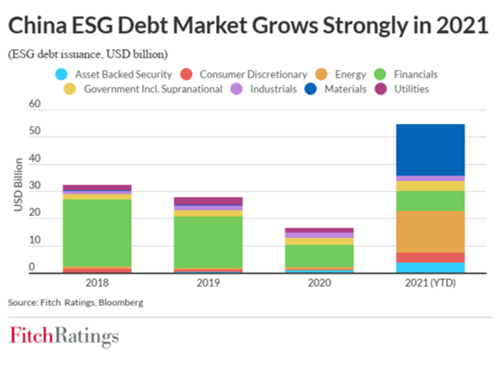

China’s ESG debt markets have grown significantly in 2021 after a setback in 2020 amid the Covid-19 pandemic. New green bond issuance reached USD22 billion in 1H21, making it the fourth-largest global issuance market by value after the US, Germany and France, according to Climate Bond Initiative.

China’s ESG debt markets have grown significantly in 2021 after a setback in 2020 amid the Covid-19 pandemic. New green bond issuance reached USD22 billion in 1H21, making it the fourth-largest global issuance market by value after the US, Germany and France, according to Climate Bond Initiative.

Read more about what Fitch believes here.