A commitment to ESG opens the door to green finance

Beyond tracking your fleet's emissions - reporting and measuring a maritime company's total emissions, encompassing all aspects of the business, is crucial for securing financing.

This article was first published in SSA's Newsletter Waves

Clement Chang is Chief Operating Officer at Metizoft, a company which supplies environmental, social and governance (ESG) services to the maritime industry as well as ship recycling solutions and lifecycle assessment. Here he takes a look at the role played by a company's ESG in securing finance.

Whether viewed through the lens of financial institutions or shareholder investment, ESG is playing a pivotal role in today's decision-making process. Taking an Asian perspective, it is evident that banks are actively embracing sustainable practices and demonstrating a commitment to achieving net-zero in terms of carbon emissions which has an impact on how they conduct business.

Clients must meet green criteria

To achieve net-zero targets, banks are emphasising alignment with green objectives among their clients. Consequently, there is a growing trend where banks are requesting owners to provide them with sustainability reports so they can assess what steps have been taken. Simultaneously, banks expect clients to establish and actively pursue goals related to carbon emissions. However, the evaluation extends beyond environmental considerations; financial institutions are delving into the social responsibility of potential clients. For example, do they have women in leadership roles within their organisation? In assessing investment potential, financial institutions require companies to adhere to specific guidelines. These include the UN Sustainable Development Goals (SDGs); the Global Reporting Initiative (GRI) which aids businesses in preparing comprehensive reports on sustainable development impacts; and the Sustainability Accounting Standards Board (SASB). The SASB mandates companies to measure, manage and report on various aspects such as the environment, human capital, social capital, business model and innovation, and leadership and Governance. Notably, in Asia, many companies are opting for SASB as they allow for quantifiable standards and achievements, encompassing areas like marine transportation standard, greenhouse gas emissions across Scopes 1, 2 and 3 as well as ecological impacts such as number and volume of spills.

Climate change is key

When seeking funding, the paramount consideration is climate change, significantly impacting investment decisions. Obtaining a green loan now hinges on the submission of a sustainability report, placing a strong emphasis on environmental sustainability and decarbonisation efforts. This aligns with developments at the International Maritime Organization (IMO), where initiatives like EDI, EXIF, and CII form integral components of the IMO Data Collection System (DCS).

Investors are demanding that companies walk the talk- have they started the transition to alternative fuels? Are they slowing their ships to conserve fuel resources?

Social standards also important

While investors are demanding commitment to sustainable practices, looking not only at the financial bottom line but also at the triple bottom line that takes account of impact on society and the environment, there are many benefits to be gained from implementing high ESG standards. For example, preventing legal complications for organisations that care for the environment, and allowing fair employers to attract and retain the best talent. However, companies do require investment to be sustainable so there is a need for a delicate balance in financial markets and financial institutions are actively working towards this equilibrium by setting parameters and monitoring performance.

Green financing in Singapore

In the Singaporean marketplace, notable changes are underway, exemplified by the establishment of the government agency Enterprise Singapore's Enterprise Financing Scheme - Green (EFS-Green). This initiative facilitates access to green financing for companies in Singapore.

Conversely, we are beginning to see green investors divest from companies that fall short of acceptable sustainability standards. What is more, this could spill over to other financial institutions who may start to take a more stringent approach to sustainability issues.

Singaporean companies particularly those listed on the Stock Exchange need to take this seriously. Merely having a glossy sustainability report is no longer sufficient, these reports are publicly available and open to scrutiny so companies must be seen to be practising what they preach. While it may have been possible to 'green wash' in the past, today every stakeholder takes an interest in actual implementation of sustainable actions taken.

Different expectations around Asia

There isn't a universally adopted reporting system that is used around the region but our observations reveal that GRI is most commonly used in Singapore and Taiwan whereas Hong Kong tends to prefer SASB, emphasising their preference for quantifiable reporting. We are also expecting a new standard to be introduced by the EU and this will impact business in Singapore and the broader Asian context as will the Cross Border Adjustment Mechanism that applies to all manufacturers that supply companies within the EU be expected to exert further influence on business dynamics in the region.

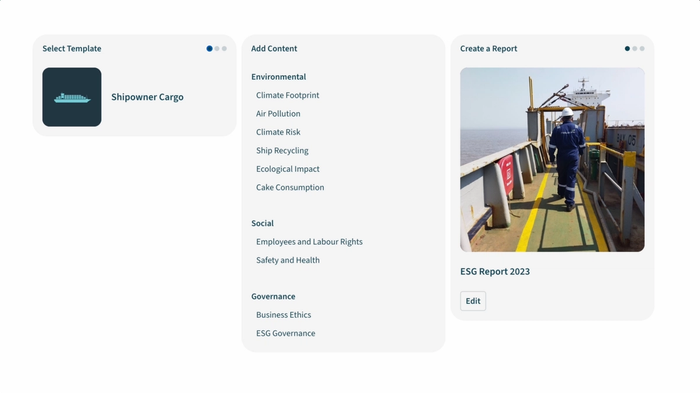

Making your business more attractive for green financing

While many companies currently produce an annual sustainability report, a more beneficial approach would involve transitioning to quarterly reporting. This adjustment allows them to closely monitor their achievements, facilitating prompt action and to implement further steps as successes become apparent. This process is not as difficult as you might imagine as there are apps available to streamline and support this process, including those from companies like ours.

But for those who are just setting out on their sustainability journey, my advice would be to start small and focus on addressing the low-hanging fruit first, particularly your Scope 1 emissions. Gradually building on these achievements will pave the way towards Scope 2 and, ultimately, Scope 3 emissions. This incremental approach is not only more attainable but also allows for the compilation of necessary data for the inaugural sustainability report.

Last updated Mar 06, 2024

- Related topics